China Digital Marketing: Reach High-spending Chinese Professionals in Hong Kong with MaiMai Marketing in 2025

Hong Kong’s affluent Chinese professionals are a crucial audience for brands looking to connect with high-value consumers. As the Exclusive Overseas Agency for MaiMai (脈脈海外獨家代理商), iClick Interactive empowers marketers to tap into this elite, career-focused audience through precise, high-impact digital campaigns.

As of the first half of 2025, MaiMai's user base in Hong Kong is primarily composed of highly educated professionals aged 30 to 40, representing 48% of users. Of these, 76% hold a bachelor's degree or higher, and a substantial number earn over RMB 20,000 per month. This strong demographic profile presents unparalleled opportunities for brands targeting high-spending Chinese consumers in Hong Kong.

![Two bar charts display MaiMai Hong Kong user demographics. The age distribution shows 48% of users are aged 30-40, while the education level chart highlights 42% hold a Master's Degree or Above and 34% hold a Bachelor's Degree. This visual reinforces MaiMai's highly educated, professional user base.]](https://www.i-click.com/wp-content/uploads/2025/06/MaiMai-visual-Age-Education-Level.png)

Source: MaiMai data as of May 2025

MaiMai’s Hong Kong Audience: A Snapshot of Affluence

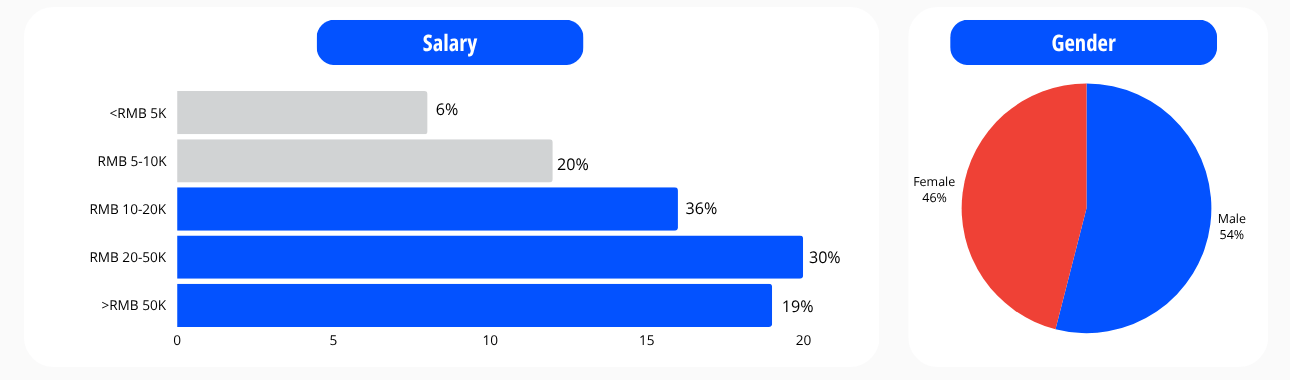

MaiMai’s user base in Hong Kong presents a significant opportunity for brands aiming to reach affluent Chinese consumers. According to the platform’s 2025 data, this demographic is well-suited for premium offerings. Notably, 49% of users earn over RMB 20,000 per month, which includes a considerable number of high-net-worth individuals, senior executives, and mid-career professionals with substantial purchasing power for luxury goods, high-end services, and exclusive experiences. Specifically, 30% earn between RMB 20,000 and 50,000, while 19% earn over RMB 50,000 monthly. Additionally, 19% of users earn between RMB 10,000 and 20,000, which also contributes to Hong Kong’s elite workforce, all possessing notable disposable income and a keen interest in premium brands and lifestyle enhancements.

Unlike broader social platforms, MaiMai's professional focus guarantees that your campaigns will effectively reach a targeted audience of affluent decision-makers. The Hong Kong audience comprises a balanced gender split, with 54% male and 46% female users. Geographically, users are primarily located in key areas such as Central and Western District (28%) and Shatin District (12%).

Source: MaiMai data as of May 2025

MaiMai in China: A Broader Context

MaiMai has established a significant presence in mainland China, with 120 million registered users and 35 million monthly active users. The platform is particularly dominant, reaching 82% of the top 500 companies in China and achieving an 86% penetration rate among major tech firms.

The platform has evolved into a "Professional Community," enabling users to engage in more than just job searches. It also fosters discussions on industry topics and lifestyle subjects, such as matchmaking and automotive discussions. This extensive engagement underscores MaiMai’s strength as a platform for connecting with ambitious and affluent professionals across Greater China, making it an essential part of any comprehensive digital marketing strategy in the region.

Why Choose iClick Interactive for MaiMai Campaigns?

At iClick Interactive, we specialize in connecting brands with affluent Chinese consumers through MaiMai’s professional network. As the Exclusive Overseas Agency for MaiMai, our partnership enables us to deliver:

-

- Precision Targeting: We can reach specific income brackets and professional segments in Hong Kong with tailored ads based on job roles, industries (such as Finance and IT & Internet, which are the largest sectors in HK), and interests. This is crucial for effective luxury marketing and retail strategies in Hong Kong.

-

- High Engagement: MaiMai’s professional environment fosters high interaction rates, allowing campaigns to resonate with Hong Kong’s career-focused users.

-

- Cultural Expertise: Our deep understanding of Chinese consumer behavior ensures campaigns align with local preferences, from luxury travel to financial services.

-

- Customized Campaigns: Whether promoting luxury goods to professionals with high disposable income, or premium retail offerings, we develop strategies that drive results in China digital marketing.

Our data-driven approach leverages MaiMai’s analytics to maximize ROI, ensuring your brand stands out in Hong Kong’s competitive market.

Opportunities for Luxury, Retail, Financial, and Other Key Brands in Hong Kong

Hong Kong’s affluent professionals are not only career-focused but also enthusiastic consumers of luxury goods, premium travel, high-end services, retail products, financial services, premium real estate, and educational services. Segments with higher incomes are particularly receptive to premium travel and lifestyle brands. Those with higher earnings tend to seek high-value services, such as investment opportunities and exclusive experiences, including private education services.

For instance, a luxury hotel chain could target individuals with higher disposable incomes by offering curated travel packages. Similarly, a financial firm could target high-earning professionals with tailored wealth management solutions, while a high-end fashion retailer could appeal to those seeking lifestyle upgrades. Our campaigns ensure that your message reaches the right audience at the right time, effectively catering to luxury marketing in Hong Kong and other key industries.

Partner with Us to Unlock MaiMai’s Potential

MaiMai offers access to a valuable Hong Kong audience of educated and affluent professionals, with many earning over RMB 20,000 monthly. By collaborating with iClick Interactive, you can create impactful campaigns that resonate with this demographic.

Whether your focus is on luxury goods, retail, financial products, or exclusive experiences, we are here to help you effectively navigate MaiMai’s powerful platform and achieve your marketing goals in Hong Kong's dynamic market.

Ready to connect with high-spending Chinese consumers in Hong Kong? Contact iClick Interactive today to explore how our China digital marketing expertise and exclusive partnership with MaiMai can drive your brand’s luxury marketing success in 2025.

Gain deeper insights into affluent Chinese consumers with iClick Interactive's research, designed to enhance digital marketing strategies in China.

-

- Engaging Affluent New Hongkongers: 2024 Digital Media Report: Pioneering report reveals digital behaviors and media habits of Chinese immigrants in Hong Kong.

-

- 2025 Chinese Luxury Travelers Whitepaper: In collaboration with Ctrip and a major Chinese payment brands, this whitepaper leverages exclusive data to unveil the motivations and behaviors of Chinese high-spending outbound travelers, offering insights for brands targeting this lucrative market.

-

- A Practical Guide to Engaging with Chinese Travelers: China Travel Retail Market Facts and Tips to Know: Travel retail marketing playbook for stakeholders, providing key insights into Chinese travel and consumption trends, along with a comprehensive overview of marketing strategies within the Chinese travel retail landscape.

More Insights

China’s Sportswear Boom: How Xiaohongshu Is Fueling a New Style Game

June 3, 2025

In 2025, sportswear is experiencing a surge on Xiaohongshu (RedNote), evolving from a focus on fitness to a vibrant lifestyle trend that seamlessly blends function and fashion. And the upcoming 6.18 shopping festival presents a golden opportunity for brands to engage this active audience.

Unlock the Future of Travel: 4 Key Trends for Chinese Outbound Travel in 2025!

June 3, 2025

The iClick 2025 Chinese Luxury Travelers Whitepaper highlights four key trends in outbound travel: a resurgence in international air travel, a preference for Asia-Pacific destinations like Hong Kong and Tokyo, an increase in spontaneous bookings among luxury travelers, and a significant presence of Gen Z travelers, who prioritize unique experiences over traditional luxury.

iSuite Insight Spotlight Issue #20: Unlocking China's Booming Health Supplement Market — Trends and Strategies for 2025

May 29, 2025

Unlock the potential of China’s health supplement market in 2025. Discover consumer trends, Xiaohongshu strategies, and tips for engaging Chinese audiences with vitamins, TCM herbs, and beauty supplements.

How Xiaohongshu is Redefining Wedding Trends in 2025

May 6, 2025

Xiaohongshu (RedNote) has emerged as the go-to platform for wedding inspirations in 2025, with wedding-related content up by 1.5 times year-over-year (YoY) and searches in 2025 increasing by 40% YoY. The platform is revolutionizing the wedding planning journeys from pre-wedding preparations to post-wedding memories.

Top Travel Trends Among APAC Tourists This May Labor Day Holiday

April 30, 2025

As the May Labor Day holiday kicks off APAC’s peak travel season, evolving travel habits and preferences—including a notable uptick in cross-border travel from China, Japan, South Korea, and Vietnam—are presenting new opportunities across the travel landscape. Let’s dive into the insights from Trip.com to see where APAC travelers go, how they stay, and what experiences they seek in this holiday.

Maximizing Travel Product Offerings with Fliggy’s Global Travel Festival!

April 10, 2025

Looking to maximize your brand exposure and drive sales? Don’t miss out on Fliggy’s New Global Travel Festival (全球旅行节)! Starting March 2025, this vibrant festival will launch on the 8th of each month. This exciting campaign offers merchants the gateway to reach millions of eager travelers through a dynamic blend of live streaming, exclusive promotions, and seasonal deals.

Unleash the Power of Customer Service Messaging on Xiaohongshu

April 3, 2025

In China’s dynamic consumer market, purchasing decisions extend beyond pricing and product quality. While authenticity is highly valued, Xiaohongshu (RedNotes) has become a key platform for brands aiming to foster trust and engagement.

Unlocking 4 Key Trends Shaping APAC Travel in 2025

March 25, 2025

As 2025 unfolds, APAC travelers are redefining the global travel landscape with evolving preferences and behaviors. According to Trip.com, emerging trends in dining, entertainment, and cruise tourism are creating fresh opportunities for brands to connect with this influential market.

Spring Sports are Buzzing on Xiaohongshu (RedNote)!

March 19, 2025

With 300 million users exploring topics like #过春天 ("Spring Activities") and #聊运动 ("Talking About Sports") on Xiaohongshu (XHS), it has become the ultimate platform for sports enthusiasts. The community is actively sharing their top spring sports tips, and interest in outdoor sports is surging, with searches skyrocketing 135% y-o-y in 2024, peaking during the 2024 Paris Olympics. Skiing is especially popular, alongside fitness, fishing, and basketball.